GAMMA EXPOSURE INFORMATION

If you want to better understand Gamma Exposure, then you must learn what dealer positioning is and how this methodology drives price action. With the displays that the bot is pushing out, it shows how major players are positioned. This has a huge impact on both intraday price action and longer term price action.

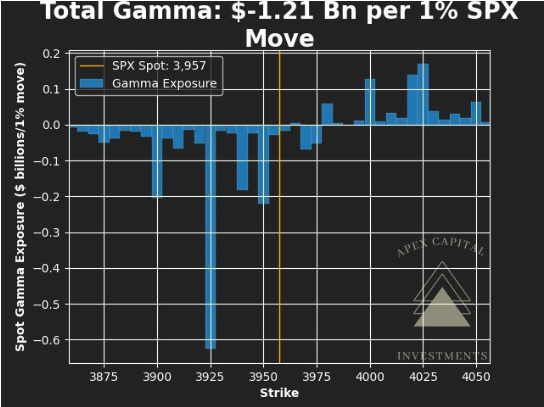

When we see a large negative gamma spike, it generally means that dealers are NET short puts at those respective strikes.

When we see a large positive gamma spike, it generally means that dealers are NET short calls at those respective strikes.

These large spikes, be it negative or positive, therefore act as price “magnets” as well as, supports and/or resistances.

You will need to understand the major difference between selling to open an option versus buying to open signifies.

WHY DOES BIG MONEY POSITIONING INFLUENCE THE MARKETS?

Case Example:

Dealers NET short calls (when dealers are NET short puts, the logic is inversed)

“Short calls” means that dealers are selling call options. This leads to Positive Gamma, they will often also be holding shares of the same underlying stock. Retail may call this selling Covered Calls. Market Makers will perform what’s called gamma hedging (or rather, delta hedging) by purchasing shares in addition to selling options. So long as there is a heavy imbalance of calls vs puts, this process often drives markets upward. It also makes supports weaker should we instead fall. If we presume dealers to be short calls at a certain strike as they are holding stock, we can also presume that they’d “ideally” like for these calls to expire worthless, while also profiting on their shares position.

When price gets to these large gamma strikes, it is logical to believe that MOST OF THE TIME, dealers will decide to simply sell their shares for profit, therby driving the market down, allowing 2 avenues of profit. Their first being their shares sold at a profit, the second being their SOLD calls expire worthless for buyers. Large gamma spikes therefor act as not only a “magnet”, but also a heavy resistance area. Understanding this will thus open up a position for retail traders to have an opportunity to play both the upside “magnet” and the rejection of the gamma target for a downside profit.

Dealer Positioning

Dealers are on the other side of these trades absorbing short institutional put and calls and hedging by taking the opposite side in futures or underlying stock. When dealer gamma imbalance is heavily long, it acts to dampen volatility. This is because dealer/hedgers will buy into highs in order to keep their books delta-neutral. Long gamma begets low volatility and low volatility begets long gamma…

A short gamma environment is certainly more chaotic. When dealer gamma profile vaults to short puts, hedgers must sell futures or stocks deeper into lows. This is exacerbated by vol-targeting and passive fund deleveraging. Given this dynamic, volatility levels accelerate quickly. Figure 1 highlights this by showing the relationship between Call-Put Gamma Dollar exposure (per 1% move, in billions), and the VIX level. It is evident that periods of heightened volatility coincide with dealer inventories that are dramatically gamma negative.